Introduction

The finance and IT sectors are becoming increasingly intertwined, forming the foundation of a sweeping digital transformation in finance. Traditional banks—once guarded by legacy systems and slow innovation cycles—are now under intense pressure to evolve. In an age of mobile banking and real-time payments, delivering customer-centric financial services has become a necessity, not a luxury. However, many established institutions are still grappling with outdated infrastructure, compliance demands, and cultural inertia that slow down meaningful innovation.

On the other hand, agile IT teams and forward-thinking tech entrepreneurs have capitalized on this gap, giving rise to the fintech revolution. These companies, often born in the digital world rather than the financial one, have introduced new standards for speed, simplicity, and personalization. They are using cloud-based financial platforms, real-time data analytics, open banking APIs, and AI-driven decision-making to rethink the way financial services are built and delivered. This ongoing financial digital transformation is streamlining everything from credit approvals to investment management—delivering faster, cheaper, and more intuitive experiences for users.

What began with digital wallets and peer-to-peer payments has now expanded into a full-scale financial services disruption—encompassing neobanks, robo-advisors, decentralized finance (DeFi), digital lending, and embedded finance. Companies like Stripe, PayPal, Revolut, and Square have grown from niche players into global platforms, becoming key architects of the future of banking and helping reshape the global financial landscape.

As this wave of digital innovation accelerates, traditional banks stand at a critical inflection point. They must either embrace banking digital transformation or risk being left behind.

Many are launching digital-first subsidiaries, partnering with fintech’s, or investing heavily in innovation labs to fast-track their modernization efforts. The boundary between tech and finance is dissolving fast—and the organizations that can successfully integrate both will lead the next generation of financial services.

Where Did It All Start?

The digital transformation of financial services has been decades in the making. Its early roots can be traced back to the rise of electronic banking tools in the late 20th century—think ATMs, credit cards, and online banking portals. These foundational technologies laid the groundwork for a more connected financial ecosystem, but they were still largely owned and operated within the traditional banking framework.

The true tipping point came after the 2008 global financial crisis, when trust in traditional financial institutions hit a low. At the same time, advancements in cloud computing, mobile technology, and smartphone adoption gave entrepreneurs new tools to build entirely digital, customer-first financial products. This marked the beginning of modern fintech—a sector that leveraged technology to democratize access to financial services, lower costs, and redesign user experiences from the ground up.

Early hubs like Silicon Valley, London, and Singapore became breeding grounds for fintech innovation, especially in areas like peer-to-peer lending, mobile payments, and online investing. Today, fintech is not just a niche—it’s a powerful global movement accelerating the digital financial transformation and shaping how individuals, businesses, and institutions interact with money.

How It’s Changing the Game

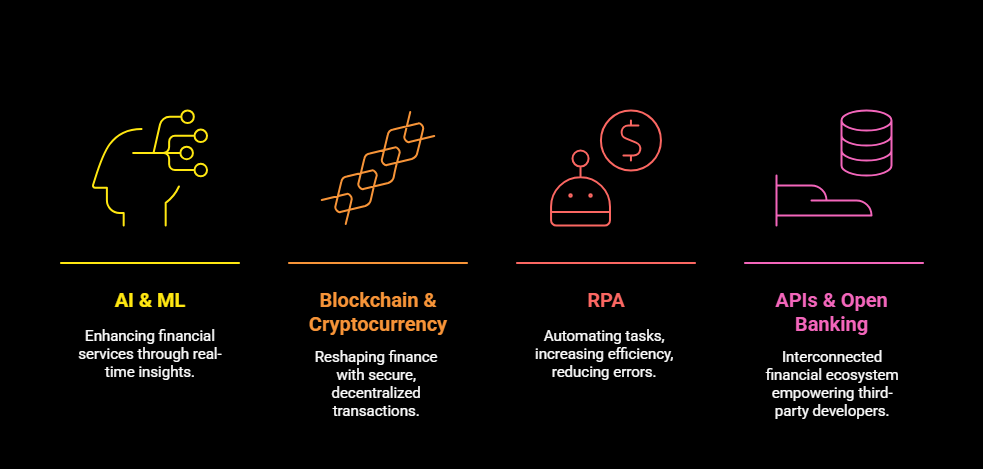

The fintech revolution is more than just a buzzword—it’s a seismic shift in how financial services are built, delivered, and experienced. No longer confined to traditional models, financial innovation is being driven by rapid advancements in technology, from AI and blockchain to automation and open banking. Fintech companies are reimagining everything from how we pay, borrow, invest, and save, delivering faster, more personalized, and more accessible solutions. This transformation is reshaping the competitive landscape, challenging long-standing financial institutions, and setting new expectations for what modern banking should look like.

Artificial Intelligence (AI) & Machine Learning (ML): Enhancing Financial Services

Artificial Intelligence and Machine Learning are at the forefront of fintech innovation, transforming how financial institutions operate and serve their customers. These technologies enable real-time fraud detection, advanced credit scoring, and personalized financial advice.

Example

- For instance, PayPal utilizes AI-driven systems to analyse millions of transactions in real-time, identifying and preventing fraudulent activities before they impact customers. Their deep learning models continuously evolve, enhancing their ability to detect suspicious patterns and anomalies .

- In the realm of credit scoring, Zest AI offers a more inclusive approach by analysing thousands of data points beyond traditional credit scores. This methodology allows lenders to assess creditworthiness more accurately, expanding access to credit for underrepresented populations .

Blockchain & Cryptocurrency: Pioneering Decentralized Finance (DeFi)

Blockchain technology and cryptocurrencies are reshaping the financial industry by enabling decentralized finance (DeFi), which allows for secure, peer-to-peer transactions without intermediaries.

Example

- Platforms like Uniswap, built on the Ethereum blockchain, facilitate decentralized trading and lending. Users can lend, borrow, and earn interest on their crypto assets, all governed by smart contracts that ensure transparency and security .

- Another example is SALT, which provides blockchain-based lending services. Users can secure loans using their cryptocurrency holdings as collateral, maintaining ownership of their assets while accessing liquidity .

Robotic Process Automation (RPA): Streamlining Financial Operations

Robotic Process Automation is revolutionizing back-end operations in the financial sector by automating repetitive tasks, thereby increasing efficiency and reducing errors.

Example

- Orange, a European telecommunications company, implemented over 400 RPA bots to automate various processes, resulting in significant cost savings and improved customer service .

- Similarly, Bank of America has leveraged RPA to enhance its operations, using AI-powered robots for tasks such as trade surveillance and transaction analysis, which has improved accuracy and compliance .

APIs & Open Banking: Empowering Financial Ecosystems

Application Programming Interfaces (APIs) and open banking initiatives are fostering a more interconnected financial ecosystem, allowing third-party developers to build applications that interact seamlessly with bank systems.

Example

- Plaid is a leading provider of open banking APIs, enabling users to connect their bank accounts with various financial apps. This integration allows for real-time expense tracking, budgeting, and investment management, enhancing user control over financial data .

- Another notable example is TrueLayer, which offers APIs that facilitate secure data sharing between banks and fintech applications, promoting innovation and improved financial services .

To Summarise

These technological advancements are not only enhancing operational efficiency but also providing consumers with more personalized, secure, and accessible financial services. As fintech continues to evolve, embracing these innovations will be crucial for financial institutions aiming to stay competitive in the digital age.

| Technology | Company | Use Case | Reference Link |

| Artificial Intelligence (AI) & Machine Learning (ML) | PayPal | Real-time fraud detection using AI to scan millions of transactions | Vangwe |

| Zest AI | Inclusive credit scoring using thousands of data points beyond traditional models | Vangwe | |

| Blockchain & Cryptocurrency | Uniswap | Decentralized exchange for peer-to-peer crypto trading and DeFi lending | Solulab |

| SALT | Blockchain-based crypto-backed loans | Investopedia | |

| Robotic Process Automation (RPA) | Orange | Automating 400+ processes across operations, saving time and cost | Itransition |

| Bank of America | AI bots for trade surveillance and compliance-related transaction analysis | Fintech Futures | |

| APIs & Open Banking | Plaid | Securely connecting user bank accounts to financial apps for expense tracking and budgeting | Geniusee |

| TrueLayer | Enabling third-party apps to access bank data securely for open banking services | Dashdevs |

The Future of Banking: Hybrid Models & Digital-First Banks

Traditional banks are no longer standing on the side-lines as digital-first banks and fintech start-ups redefine customer expectations. To stay relevant, many incumbent institutions are now actively embracing digital transformation by either partnering with fintech firms or launching their own digital-only subsidiaries. A prime example is Marcus by Goldman Sachs, a digital bank designed to offer high-yield savings and loans with a clean, tech-forward interface—competing directly with fintech challengers. Similarly, Zelle, a peer-to-peer payment platform developed by a consortium of major U.S. banks, was created as a direct response to the popularity of Venmo and Cash App. These moves reflect a broader strategy: adopting digital tools without abandoning the regulatory and infrastructural strengths that traditional banks possess.

We’re witnessing the emergence of a hybrid financial ecosystem—one that blends the stability, brand trust, and regulatory expertise of traditional banks with the speed, innovation, and customer-centric design of digital-first fintech’s. Rather than attempting to outpace fintech’s on their own turf, legacy banks are increasingly focused on modernizing their tech stack, improving mobile banking experiences, and enhancing personalization through AI and analytics. This hybrid model allows them to retain their long-standing customer base while attracting a new generation of digital-savvy users. It also signals a future where cooperation and co-existence—not just competition—will shape the next era of banking.

Benefits to the Customer

The consumer is, without a doubt, the biggest winner in this transformation:

- 24/7 Accessibility: Manage finances from your phone, anywhere, anytime.

- Lower Costs: Fewer fees, more transparency.

- Speed & Convenience: From loan approvals to account setup—everything is faster.

- Personalized Services: AI-driven insights help tailor financial advice to individual needs.

- Financial Inclusion: Fintech has opened doors for the unbanked and underbanked populations globally.

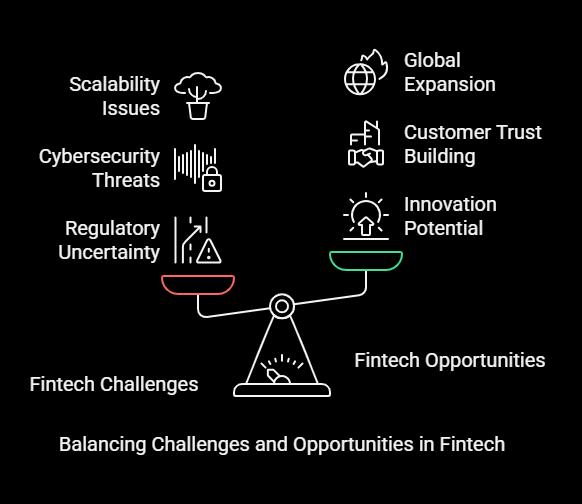

Challenges Ahead

While the fintech revolution has brought about remarkable progress, it also introduces a new set of challenges that both digital disruptors and traditional banks must navigate. From tightening regulatory scrutiny and cybersecurity threats to questions around data privacy and scalability, the path forward is far from simple. As the industry matures, the pressure to innovate responsibly while maintaining trust, compliance, and operational resilience becomes more critical than ever. Understanding these obstacles is essential to shaping a sustainable, customer-first future in financial services.

- Regulatory Uncertainty: Rapid innovation often outpaces regulation, especially in crypto and DeFi.

- Cybersecurity Threats: More digital services = more attack surfaces.

- Customer Trust: New fintech’s must earn the trust that traditional banks have spent decades building.

- Scalability: Not all fintechs can handle explosive growth or global expansion.

- Fragmentation: The sheer number of services can overwhelm users and create disconnected experiences.

Conclusion

The clash between traditional banks and fintech disruptors is often framed as a battle—but the reality is more nuanced. While fintech’s have clearly set new benchmarks for user experience, speed, and innovation, they still face challenges around regulation, long-term trust, and scalability. On the other hand, traditional banks bring decades of credibility, deep regulatory know-how, and robust financial infrastructure—but often struggle with agility and modern customer expectations. The answer, then, isn’t about who will win—it’s about how these two forces can complement each other.

The future of finance lies in collaboration, not conflict. As customers increasingly demand both security and simplicity, banks and fintech’s will need to blend their strengths. Traditional banks must continue to adopt a digital-first mindset, while fintech’s should tap into the stability and scale of legacy institutions. Whether through strategic partnerships, joint ventures, or API-driven ecosystems, this hybrid model will ensure that the end user—the customer—reaps the real benefits: better financial access, personalized services, lower costs, and greater transparency. In this evolving landscape, it won’t be about choosing sides—it’ll be about choosing synergy.

What are the main benefits of fintech for customers?

Traditional banks are adapting to the rise of fintech by embracing digital transformation, launching digital-only platforms, and partnering with fintech companies. Fintech benefits customers by providing improved accessibility, personalized experiences, and greater financial inclusion through mobile apps and innovative services. Key factors driving disruption include technological advancements, changing customer expectations, and regulatory shifts that encourage competition and lower costs.

What are the key challenges this industry is facing?

Despite its growth, fintech faces challenges like regulatory uncertainty, especially in crypto and DeFi, and increasing cybersecurity risks. New fintech’s must also build customer trust, scale effectively, and navigate fragmentation in the market that can overwhelm users with disconnected experiences.